Stay informed and up-to-date with the latest financial updates to enhance your decision-making and optimize your investment strategy. In today’s fast-paced and ever-changing economic environment, understanding market trends and economic shifts is crucial for making smarter financial choices. Regularly reviewing the latest market recaps and economic analyses gives you a clearer view of key market developments, industry movements, and broader economic factors that can impact your investments and financial plans.

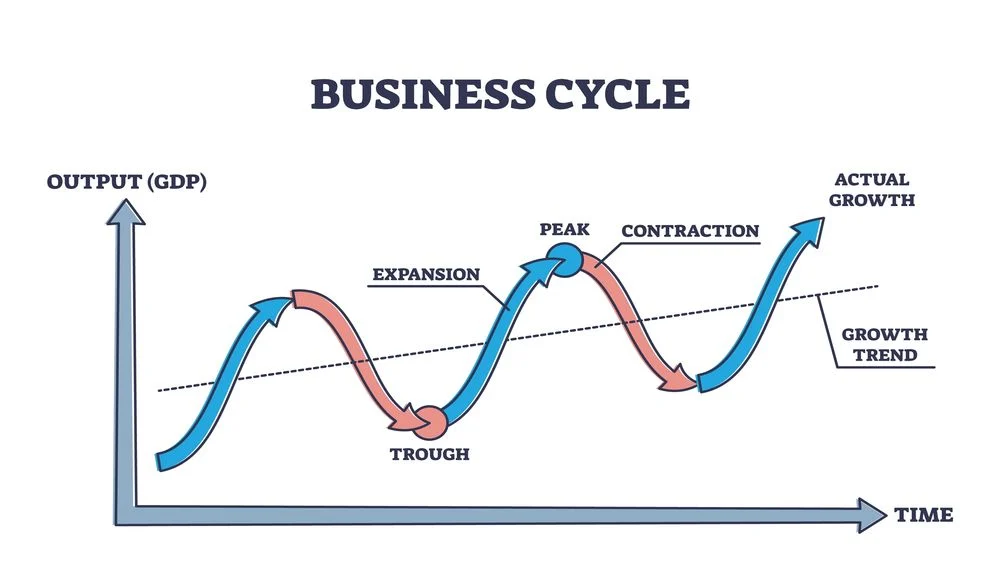

Our comprehensive updates provide in-depth insights into market performance across equities, bonds, commodities, and currencies, while also highlighting critical economic indicators such as inflation, GDP growth, employment trends, and central bank policies. By consistently monitoring these trends, you can confidently navigate market volatility, identify emerging opportunities, and effectively manage risks in an increasingly dynamic financial environment.

In addition, our expert analysis simplifies complex data, offering actionable intelligence that supports well-informed and timely decision-making. Whether you are an experienced investor aiming to optimize portfolio performance, a business leader working to stay ahead of market dynamics, or an individual managing personal finances, our insights empower you to make proactive, goal-oriented choices aligned with your financial objectives.

Furthermore, by staying updated with our regular reports, you can better anticipate market shifts, adapt strategies to changing conditions, and build resilience in the face of uncertainty. Our actionable insights are specifically designed to help you enhance your long-term financial success by fostering a deeper understanding of global economic patterns and market drivers. As a result, with our guidance, you can confidently navigate the complexities of the global economy, make strategic decisions, and position yourself for sustainable growth and profitability in an ever-evolving financial landscape.