Happy Friday! We’re going to be transitioning to a smaller (but still informative!) weekly update to make sure you’re getting the info you need as you head into the weekend. As always, feel free to reach out if you need anything.

📊 Weekly Market Recap

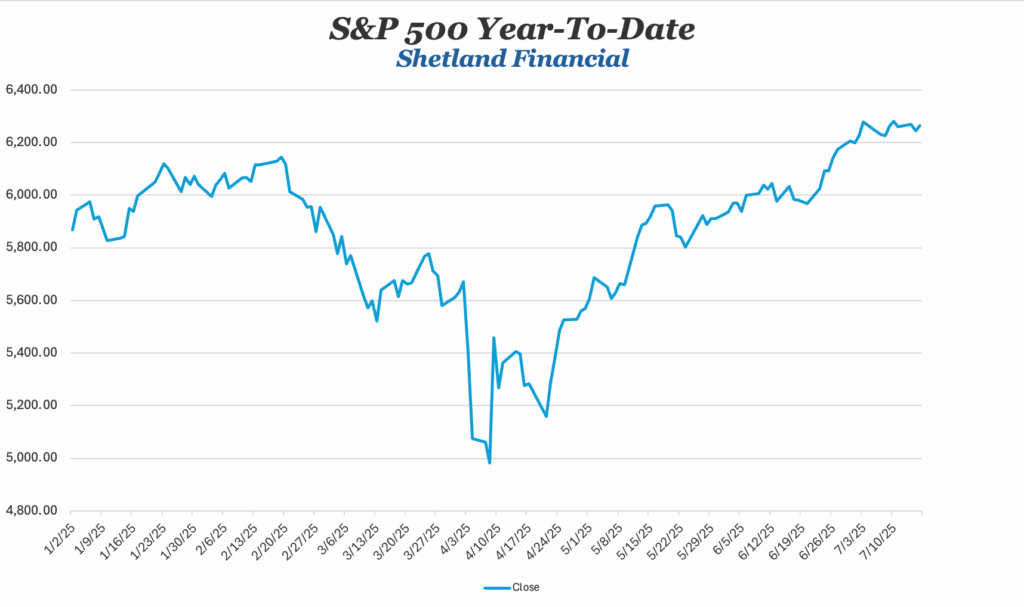

- S&P 500 returns in the past week have been about .7%

- S&P 500 returns so far in July have been about 1.5%

- S&P 500 return year-to-date have been approximately 7.8%

This Week in the Markets- 3 Things to know

1. The Fed’s latest report shows U.S. economic activity ticked up in June and early July, but businesses remain neutral amid rising tariffs and labor shortages

2. The NASDAQ notched another record high on July 15, buoyed by Nvidia’s upbeat outlook for China chip demand.

3. U.S. consumer sentiment jumped to 60.7 in June—its biggest monthly gain this year—though it remains about 11% below June 2024 levels, raising worry about how tariffs will affect prices in Q3 and Q4

Only other thing to keep an eye on is the brewing fight between Trump and Fed Chairman Jerome Powell. Presidents complaining about the Fed not lowering rates is as American as apple pie, so there’s nothing too new on that front. But the Fed IS actually being a little bit of an outlier compared to other central banks with their reluctance to lower rates (Europe has cut rates four times already this year, for instance). So there is actually some legitimate griping. The Fed’s decision to spend $2.5 billion on a new HQ is somewhat irrelevant (though incredibly dumb and tone-deaf), but I doubt it actually leads to Powell being pushed out. So my early guess is that they finally cut at the next meeting and claim it was just coincidence.

S&P 500 Snapshot- Past Month

Top Movers In the Market Year-To-Date

Lets review your Portfolio

At Shetland Financial, we know that smart investing starts with understanding your unique comfort level with risk. That’s why we’ve partnered with Nitrogen®, the industry-leading platform for risk alignment, to give you a data-driven, personalized investing experience.

Enhance your financial journey by taking just a few moments to complete our comprehensive Risk Assessment Questionnaire—designed to help us understand your unique goals, time horizon, and comfort with market fluctuations.

Take the first step toward a portfolio that’s designed with you in mind. If you have any questions along the way, our dedicated advisors are just a click or call away—so you can move forward with confidence.

Tap here to set up your meeting today! We look forward to working with you!