I Read the Tax Bill So You Don’t Have To I hope you all enjoyed a long holiday weekend. While […]

Currently browsing: Business Tax

Trusts

The Basics of Trusts A trust is a legal arrangement where one party (the “grantor”) transfers assets to another (the […]

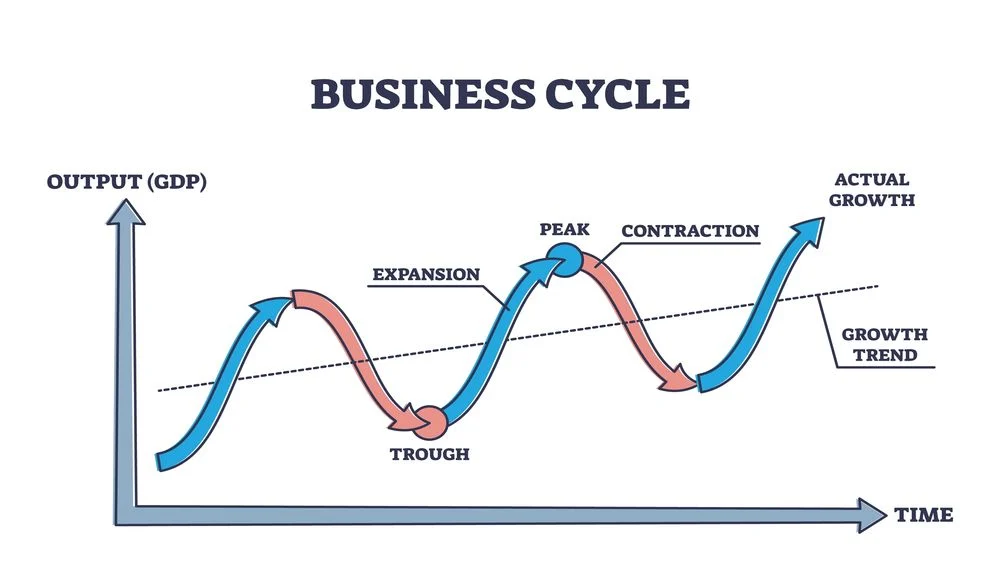

Business Cycles

Understanding Business Cycles In the realm of economics, the concept of business cycles is both intriguing and crucial. It’s a […]

Rental Property and Their Tax Benefits

Owning a rental property can provide several tax benefits for property owners. It’s important to note that tax laws can […]

Annuities…What Are They?

Annuities are financial products that provide a series of payments made at equal intervals. They are often used as a […]

How to Align Your Tax Strategy with Annual Planning

Having a well-thought-out tax strategy for your business is an important step to take in order to make the most […]

Tax Planning for Corporations: Do’s and Don’ts

Proper tax planning for corporations is necessary to ensure the continued financial success of your business. A strong tax plan […]

Creating and Tracking Financial Goals for Business

Setting financial goals for businesses can be a daunting task. However, the benefits of outlining and adhering to financial goals […]

Business Planning: How to Connect Your Data to Goals

Data tells the story of your business, and goals give your business a benchmark to strive for. To get the […]

Is Your Tax Plan Proactive or Reactive?

While most people understand the importance of tax planning, many don’t know the difference between a proactive and reactive approach. […]

Categories

- Business Accounting 25

- Business Tax 23

- Investing 18

- Market Recap 42

- Personal Finance 25

- Real Estate 5

- Retirement 7

- Uncategorized 1