Understanding Business Cycles

In the realm of economics, the concept of business cycles is both intriguing and crucial. It’s a phenomenon that has intrigued scholars, policymakers, and business leaders alike for centuries. From booms to busts, from periods of prosperity to recessions, the business cycle shapes the economic landscape in profound ways. Lets deeply entrenched in financial analysis and strategic planning, we recognize the importance of comprehending these cycles for our clients and their businesses.

What are Business Cycles?

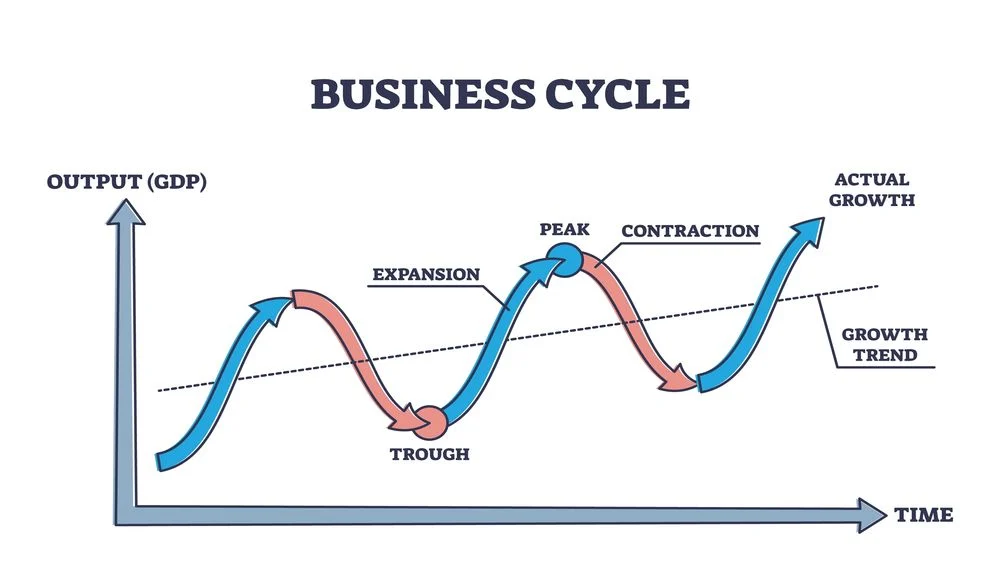

Business cycles refer to the recurring patterns of expansion and contraction in economic activity. These cycles typically encompass periods of economic growth, followed by downturns, and then recoveries. While the exact duration and intensity of each phase may vary, the cyclical nature of economic activity remains constant.

Phases of the Business Cycle

- Expansion: During the expansion phase, economic activity flourishes. Businesses thrive, consumer spending increases, and employment levels rise. This phase is characterized by robust GDP growth, rising corporate profits, and optimistic market sentiments. As demand for goods and services escalates, companies often invest in expansion projects and innovation to capitalize on favorable economic conditions.

- Peak: The peak marks the pinnacle of the business cycle. It represents the point at which economic growth reaches its maximum potential. However, this phase also signals the onset of a slowdown. As capacity constraints emerge and inflationary pressures build up, central banks may implement monetary tightening measures to curb excessive inflation.

- Contraction: Also known as a recession, the contraction phase signifies a period of economic decline. Demand weakens, unemployment rises, and business activities contract. Falling consumer confidence, declining corporate profits, and reduced investment expenditure are common features of this phase. Governments and central banks often deploy fiscal and monetary stimulus to mitigate the adverse effects of the recession and stimulate economic recovery.

- Trough: The trough represents the nadir of the business cycle. It marks the end of the recessionary phase and the beginning of economic recovery. At this stage, economic indicators start to show signs of stabilization and improvement. Unemployment may peak, and consumer confidence begins to gradually recover. As businesses adapt to the changing economic landscape, investment and consumption levels slowly pick up momentum.

Navigating Business Cycles: The Role of CPAs

As trusted financial advisors, CPAs play a pivotal role in helping businesses navigate the complexities of the business cycle. Here are some key ways in which CPAs assist their clients:

- Financial Planning and Analysis: CPAs conduct comprehensive financial analyses to help businesses anticipate and prepare for fluctuations in the business cycle. By assessing the financial health of their clients and identifying potential risks and opportunities, CPAs enable businesses to develop robust financial strategies that withstand economic volatility.

- Risk Management: CPAs assist businesses in identifying and mitigating risks associated with the business cycle. Whether it’s managing liquidity risk, market risk, or operational risk, CPAs provide valuable insights and recommendations to safeguard their clients’ financial interests during periods of economic uncertainty.

- Strategic Decision-Making: CPAs offer strategic guidance to businesses, enabling them to make informed decisions in response to changing economic conditions. Whether it’s adjusting production levels, revising pricing strategies, or reallocating resources, CPAs help businesses adapt their strategies to capitalize on emerging opportunities and navigate challenges effectively.

- Compliance and Regulatory Compliance: In an ever-evolving regulatory landscape, CPAs ensure that businesses remain compliant with relevant laws and regulations governing financial reporting, taxation, and corporate governance. By staying abreast of regulatory changes and requirements, CPAs help businesses minimize compliance-related risks and maintain their reputational integrity.

Conclusion

In conclusion, business cycles are an intrinsic aspect of the economic landscape, influencing the fates of businesses and economies. They play an instrumental role in assisting businesses in maneuvering through these cycles. By offering financial expertise, strategic direction, and risk mitigation strategies, they enable businesses to navigate through economic challenges and seize opportunities for advancement and prosperity.